Heirs

Sogeni contacted you in connection with a vacant succession ? Take the time to find out who we are, what probate genealogy is about and why this succession concerns you.

Why was I contacted by Sogeni ?

A relative you do not know has deceased without children or any other relative closer to you. Sogeni SA is a probate genealogy firm that has undertaken research and identified you as entitled to the estate. You can learn more about :

– Our profession: probate genealogy

– Swiss inheritance law, which designates legal heirs

– The process and steps to assert your inheritance rights

Under Swiss succession law, in the absence of a Will or a succession agreement, the heirs are determined by law. Legal heirs so designated may never have known the deceased who left the estate vacant.

FAQ

Are you involved in a probate search ? Here is the information you need to know.

The following eight questions address the key topics in relation to probate research and the settlement of a vacant estate. They should answer any interrogation you may have following Sogeni’s contact.

Feel free to reach out to our teams to answer any other questions.

Why was I contacted by Sogeni without asking ?

How can I inherit someone I don’t know ?

Why was I not contacted by a public notary or estate administrator?

What are the steps and process to assert my rights to the estate ?

Signature of the “basic agreement” and “specific authority”

When an heir has been found, Sogeni contacts him or her to submit a basic agreement. By this agreement, Sogeni undertakes to provide the heir with proof of his rights in the succession which she proposes to disclose upon official acceptance of the heir status by the concerned administrations and / or funds holders. With the signing of this agreement and a specific power to carry out certain administrative steps, the heir mandates Sogeni to officially establish his rights to the inheritance. The basic agreement also sets Sogeni’s remuneration for the services rendered, stating that the latter will be due only if the succession is positive and accepted.

The signature of the basic agreement and the specific authority is therefore the starting point of the process allowing the heir to assert his rights.

Submission of the heir file to the authorities in charge

With the mandate given by the heir, Sogeni will be able to build a file to have him recognized as a beneficiary of the vacant estate. The file will contain in particular all official documents proving the relationship between the heir and the deceased.

Succession case details disclosure

Once the file has been accepted by the authorities and, if applicable, after the administrative deadline set for heirs to declare themselves has expired, Sogeni will be able to reveal the identity of the deceased to the heir. At this stage the assets of the estate are generally not yet known to Sogeni.

Inventory disclosure and acceptance or repudiation of the succession

Some time after the expiry of the administrative deadline, the authorities shall disclose the inventory showing the assets and debts of the estate. Two alternatives are then available :

- Acceptance of the succession and application for the heir certificate, in case of a positive net balance of the estate.

- Repudiation of the succession, in case of a negative net estate.

In the event of a repudiation of the succession, Sogeni’s mandate shall end and all costs incurred up to that time shall be borne by Sogeni. The heir shall not inherit any debt or incur any costs.

Estate liquidation and remittance of funds to the heirs

In case of a positive estate, the process continues with all steps of liquidation and settlement of the succession. In this phase Sogeni is responsible for carrying out or coordinating all operations in the interest of the heir(s) she represents. Having received a power of attorney from the latter for these purposes, she ensures that the partition of the succession is calculated in accordance with the applicable law and that the estate is settled in full compliance with the tax and judicial authorities.

Once the estate is wound up, each heir receives his share of the inheritance, less the inheritance tax and the remuneration of Sogeni for the services provided, according to the rates set out in the “basic agreement”.

Are there any expenses to be paid or advanced by the heir ?

What happens if the estate balance is negative ?

Does Sogeni contact people by e-mail ?

How do I ensure that Sogeni’s proposal is not a “scam” ?

The numerous malicious solicitations that everyone is subject to today give rise to an understandable mistrust.

We recognize that in the context of a probate search, heirs sometimes feel that they have been contacted “out of nowhere”. Without knowing the existence of Sogeni or even the profession of probate genealogist, it is natural for the heir to question the validity of a proposal which he himself did not solicit. Here are the elements that will allow you to ensure that our approach is authentic and the verifications we recommend to make, should you have suspicions about a possible malicious proposal.

Request for advance or payment of fees or expenses

Sogeni, like any professional propate genealogist, will never ask you to advance or pay fees at any time in the process of establishing and asserting your rights to an inheritance.

If someone contacts you, pretending to be a probate genealogist, and asks you for a fee, you must stop the process immediately.

Making personal contact

Sogeni prefers contacting presumed heirs by telephone or postal mail, even if we have sometimes to make contact by e-mail, especially for heirs living abroad. If you have any doubt or think you have received a malicious e-mail on behalf of Sogeni, we would appreciate if you let us know by calling our office.

The person from Sogeni who contacted did a self-introduction and gave you his or her name and coordinates. You may call our offices back at any time to speak with him or her.

If someone approaches you without giving you their identity or telephone information, it can be suspicious.

Verifiable and consistent information about the company

Our company is established and physically present in offices located Avenue du Théâtre 7 in Lausanne, Switzerland. You can confirm easily with some research the existence of these offices. In addition, the company is registered in the Swiss Trade Register, available on the official site Index central des raisons de commerce (zefix.ch)

If you are approached by a so-called company, check the Trade Register and make sure the physical address makes the existence of the company credible.

Professional networks and accreditations

Sogeni is represented, through its team members, in professional networks which are the references in its areas of expertise:

APG (Association of Professional Genealogists)

STEP (Society of Trust and Estate Practitionners)

Swiss succession law

The succession law defines who inherits as well as the share belonging to each heir of the deceased.

What is a succession ?

When a person deceases (de cujus), all his property and any debts are transferred to his heirs.

The latter become joint owners of the property and in principle can only dispose of it together, at least until the division has taken place. They thus form the hereditary community.

In order to define the succession, the matrimonial regime must first be liquidated.

Several schemes exist and define the terms and conditions of succession:

- participation in acquired assets,

- separation of property,

- community of property

- specific marriage contract.

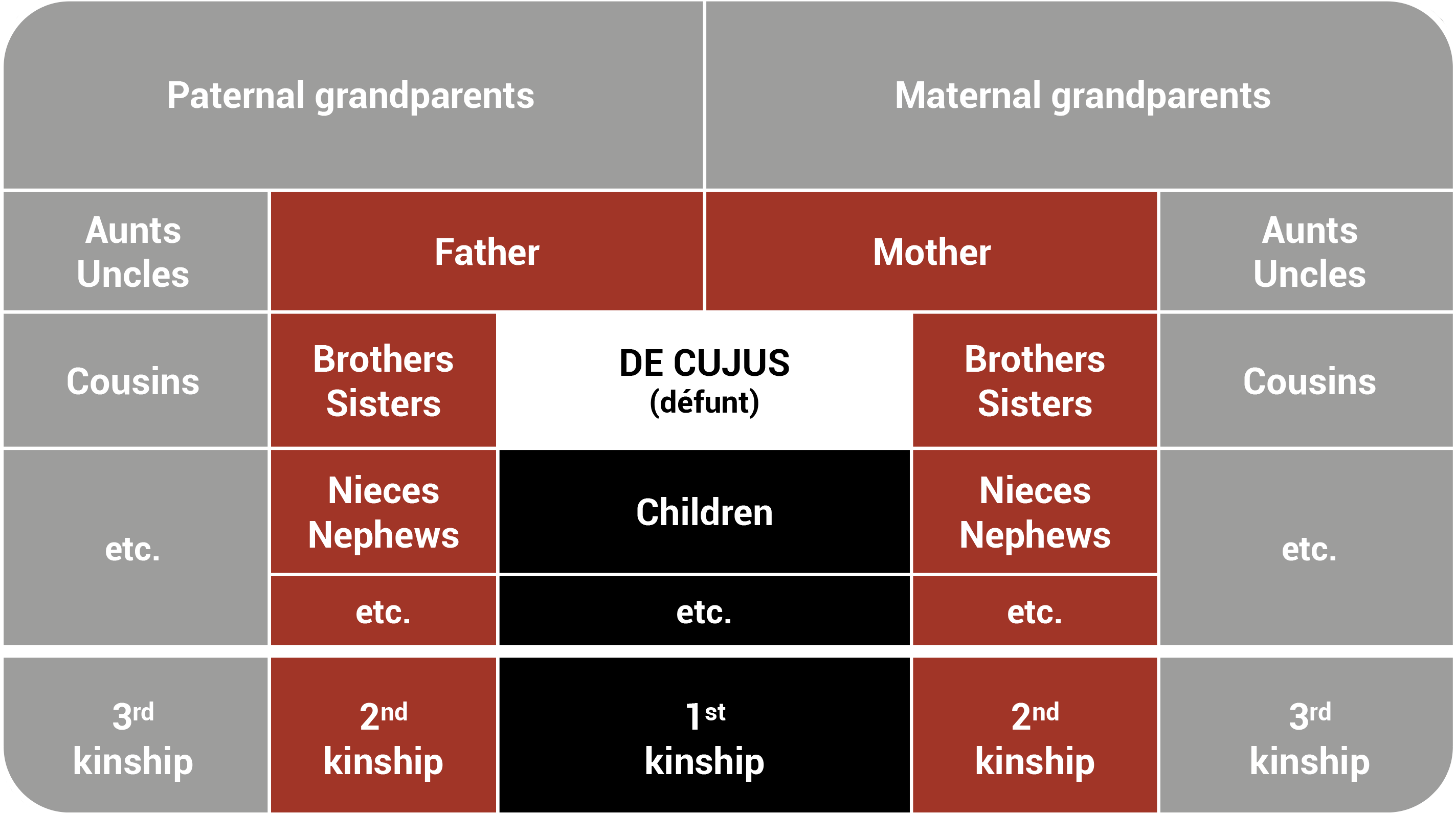

Who are the heirs ?

In the absence of a Will or a succession agreement, the heirs are determined by law. The spouse retains the status of heir, while for other family members it depends on the degree of kinship with the deceased parent.

There are three groups eligible for a share or whole of the succession :

- First kinship: the progeny of the de cujus (children, grandchildren, etc.)

- Second kinship: composed of the father and mother of the de cujus, his brothers and/or sisters and their descendants i.e. nephews, nieces, etc.

- Third kinship: the grandparents of the de cujus, and/or their descendants, i.e. uncles, aunts, cousins, etc.

Any person who does not belong to one of these relatives cannot claim to be an heir. The law defines the order in which the members of the family inherit as well as the share belonging to each heir. The law defines the order in which the members of the family inherit as well as the share belonging to each heir.

Glossary

Are you lost in the legalese surrounding any succession file? This glossary will help you to see more clearly.

Administrator / Administration of the estate

The administration of the estate is a security measure provided for by the Swiss Civil Code to ensure the conservation of the estate and to determine all the heirs called to collect the succession when those are not able to do so for various reasons.

The Justice of Peace (equivalent in Switzerland to Anglo-Saxon countries probate court) may order the administration of the estate in the following circumstances:

• in the event of a prolonged absence of an heir, if it is in the best interests of the heir;

• whether there is any doubt that there is an heir or whether there is any doubt as to the status of heir;

• when no heir is known.

If there is an executor, the executor is in principle responsible for the administration of the estate.

When an administration is put in place, the management of the estate is entrusted to the administrator who ensures the day-to-day administration (in particular cancelling unnecessary commitments and paying debts to avoid penalty interests or prosecution).

Beneficium Inventarii

Beneficium inventarii (literally benefit of the inventory) is a legal doctrine introduced into Roman law by Justinian I to limit the liability of heirs resulting from an insolvent estate.

The doctrine, which is in force today in many civil law systems, applies to both wills and intestate successions. An heir may accept a succession under beneficium inventarii without being liable for the debts attaching to the estate or to the claims of legatees beyond the estate’s value as previously determined by inventory.

The inventory procedure is implemented on request and allows the heirs to know the assets and liabilities of the estate and to limit their responsibility to the debts that are charged to the inventory.

The application may be made, within one month of the death or as soon as an heir has become aware of his capacity, to the probate court by any heir having the power to repudiate the succession.

It is then the probate court who takes necessary steps to establish all the assets and liabilities of the deceased person.

After its closure, the inventory is brought to the attention of the heirs who, within one month, must declare to the probate court whether or not they accept the succession. In the event of acceptance, they shall be liable for the debts of the succession entered in the inventory.

De Cujus

The de cujus is the alpha of the genealogy, the one by whom it all begins. But before being taken up by genealogists, this Latin expression was part of the legal jargon of notaries, especially in the context of successions.

De cujus successione agitur

«De cujus» are the first words of the Latin phrase «de cujus successione agitur», which means the one whose succession it is».

Out of delicacy, notaries have become accustomed to using this expression when drafting a marriage contract or a Will so that in his presence the donor is not named in the act he signs by the expression “the (future) deceased”. The de cujus is therefore the testator, and later becomes the deceased whose succession is settled.

Executor / Executrix

The deceased may have designated in his Will a person responsible for the execution of his last wills. He/she is the executor/executrix. By accepting the entrusted mission, it is then solely up to him to manage the succession. He has an independent position with regard to the heirs and may alone take any necessary steps to carry out his mission.

The Justice of Peace is the supervisory authority for executors of wills.

Heir certificate

The capacity as heir of a person is attested by the heir certificate, which indicates all persons entitled to the succession. It is the equivalent of probate in Anglo-Saxon countries.

The heir certificate is almost always required as proof of his capacity as heir with the authorities or third parties (for example with the banks) and thus to be able to dispose of the inherited assets. The heir certificate shall be issued at the request of the heirs or their representatives.

Hereditary community

If there are several heirs, they form a hereditary community, with rights and obligations. The heirs are the owners and jointly dispose of the property that depends on the succession. They are also jointly liable for the debts of the deceased. This solidarity ceases 5 years after the division and distribution of the estate.

Intestate

When an individual has died without leaving a Will, he is said to have deceased intestate.

Kinship

Heirs are classified in kinships, i.e. in groups of relatives. The succession shall not return to a relative of a kinship unless all representatives of the previous kinship have died.

There are three groups eligible for a share or whole of the succession :

• First kinship: the progeny of the de cujus (children, grandchildren, etc.)

• Second kinship: composed of the father and mother of the de cujus, his brothers and/or sisters and their descendants i.e. nephews, nieces, etc.

• Third kinship: the grandparents of the de cujus, and/or their descendants, i.e. uncles, aunts, cousins, etc.

Within a kinship, deceased relatives are represented by their descendants.

In the absence of heirs of the third kinship, the succession is devolved to the canton and/or the commune of the last residence of the deceased.

Official liquidation

The official liquidation of the estate shall take place at the request of at least one of the heirs, provided that the succession has not been accepted by another. The request must be made within three months after the death or the date the heir is made aware of his status.

The official liquidation removes the personal liability of the heirs by separating their patrimony from that of the deceased.

The heirs then have no right to the assets and no longer answer the debts of the deceased. Their participation in the succession shall be limited to any outstanding balance at the end of the official liquidation.

Probate court

In most Anglo-Saxon countries, a specialised division of justice called probate court handles cases concerning the distribution of deceased people’s estates. In Switzerland the Justice of Peace is the judiciary administration in charge of successions.

Repudiation

Heirs who do not wish to assume the debts of the deceased or to intervene in the succession must repudiate it within three months following the death or the knowledge of their capacity of heir.

Once the succession is repudiated, the heirs no longer have any right to the assets and no longer answer the debts of the deceased. They are no longer part of the hereditary community.

In case of repudiation by all the entitled heirs, the succession is liquidated by the bankruptcy office.

Legal reserve

The closest heirs cannot be totally excluded from a succession. Swiss succession law sets a minimum share of the estate which they cannot be deprived of: this is called a legal reserve.

This legal reserve is:

– for a descendant: half of his/her inheritance right;

– for the surviving spouse: half of his/her inheritance right.

After the changes in the Swiss succession law, taking effect on 1st January 2023, there is no legal reserve any more for the father or mother of the deceased.

Testator

The testator is the person who has left a Will.

Will

A Will is an act by which the future deceased (in that case also called the testator) expresses his last wishes. It may be revoked, modified or deleted at any time. The testator shall have the discretion to designate the beneficiaries of the available portion of his estate, that is, the remaining portion after determining the applicable legal reserve.

A Will may be filed with a notary, a lawyer, a trustee, a third party or the executor of the will. It must meet certain formal requirements to be valid. At the time of death, the original of the will must be sent without delay to the probate court (Justice of the Peace in the case of Switzerland) of the last domicile of the deceased.

Testimonials

A selection of messages from our beneficiaries.

Now after fourteen months of effort, the inheritance was successfully released. I sincerely thank the professionals at Sogeni for identifying the opportunity, contacting me, and patiently working with me and my family in releasing the inheritance. Without any reservations, I recommend Sogeni as an expert in International Heir Search and Probate Genealogy. I particularly recognize Manuel BONNET and Marie-Claude CORTICCHIATO for their leadership and expertise.

Thank you.

PFV

Dear Mrs Corticchiato and Mr. Delangle,

I would like to extend my extreme appreciation to SOGENI and the entire staff there. I, as many probably are, was very hesitant to partake in this situation, but as a result, I have had a life altering experience. I want to personally thank everyone involved at SOGENI, for their hard work and patience. I for sure had my doubts. Thanks again, and please feel free to use me as a reference any time! You perseverance does not go unnoticed. Much appreciated….

J.W.

USA, 20.10.2019

Chère Madame Floris,

Je vous remercie beaucoup pour tout le travail que vous avez fait, pour la succession de Monsieur xxxxxxxxxxxxx.

Meilleures salutations

E.H.

Dear Ms Corticchiato, Mr Delangle and Mrs Gilbertas

I trust you are all safe, amidst these unknown times.

Thank you for your every professional effort during this process, for which I am grateful and fortunate to have been a part of.

I wish to request a quotation for the cost of your family tree research services please.

The families I am interested are of both my parents. This was done by a relative in CH in 1970’s, dating back to the 1613 in Root viz Heinrich Arnet being a direct descendant of 9 generations.

I can send an updated copy of the information I have to date if this helps.

Thanking you and stay safe ?

Kind regards

J.B.A.

Dear Marie-Claude,

Thank you very much for everything that you have done for us.

We are all very grateful.

Please thank everyone involved in the process, from finding us to depositing the final settlement.

All the best to you.

You’ve been wonderful and patient with the questions and moments of uncertainty that we had.

Much appreciated and good luck for the future.

T.N., Sh.N and St. N.

Chère Madame,

Je vous écris simplement pour confirmer l’arrivée des fonds, et pour vous remercier vivement pour tout votre travail. Le processus était long, mais vous et tous vos collègues avez toujours été efficaces, professionnelles, et aimables, et j’apprécie vos efforts.

Bien cordialement,

A.A.

Buongiorno,

La presente per ringraziarvi dell operato della vostra azienda, in particolare delle vostre persone Sig ra Corticchiato e Sig ra Floris.

Porgiamo

Cordiali Saluti,

A.C.